Property Taxes

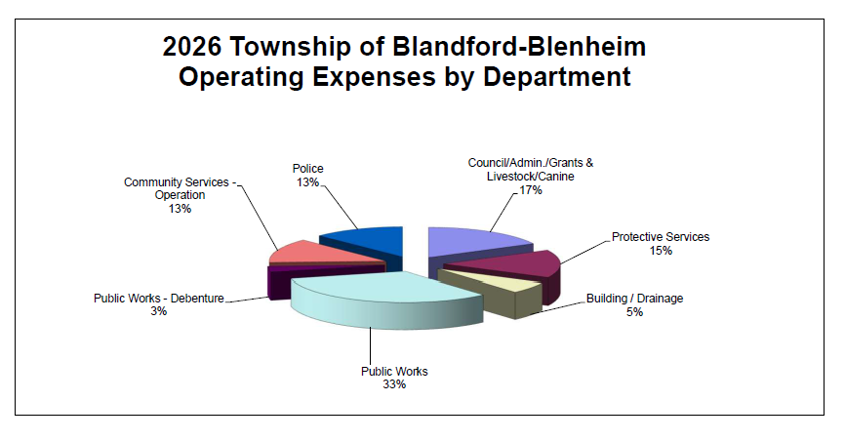

Your taxes provide the following services:

- Police protection

- Fire protection and prevention emergency services

- Construction and maintenance of roads and sidewalks

- Bridges and culverts

- Municipal drains

- By-law enforcement and property standards

- Building permits and inspections

- Animal Control

- Planning and Zoning services

- Recreation facilities – Arena/Parks/Pavilions/Community Centres

- Emergency planning

- Licenses and permits

- Cemeteries

Property taxes collected by the municipality include rates for the upper tier, the lower tier, and for education.

For more information about your property tax rate:

Interim Tax Bills are the first property tax bills of the year and are based on your prior year’s annualized taxes. Interim billings are calculated as 50% of the prior year’s annualized total tax billing spread out over the 2 payments.

Final Tax Bills are the second property tax bills of the year and are calculated as follows:

- Assessment x Property Tax Rate = Total Property Taxes for the Year

- Final Billing ** = Total Taxes – Interim Billing (this is split over the final 2 payment dates)

** Please note that Commercial, Industrial and Multi-Residential Taxes are subject to capping calculations.

** Final Billings will also include any area-rating and local improvement charges for the full year.

All properties in Ontario are assessed by the Municipal Property Assessment Corporation (MPAC), using current market valuation. MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities whose role is to accurately value and classify all properties in Ontario according to the Assessment Act and regulations established by the Ontario Government. Properties are assessed every four years and assessment values are phased in over a four year period. For information about changes to your property assessment, visit AboutMyProperty. To change the direction of school support for the education portion of your property taxes, complete the Application for Direction of School Support. If you have any questions, please contact your local school board. For more information, MPAC has a YouTube Channel and Twitter feed.

Installments

1st - Last business day of February

2nd – Last business day of May

3rd – Last business day of August

4th – Last business day of October

Payments can be made by telephone or internet banking, by mail, in person at our office (8:00 am – 5:00 pm Monday to Friday, by cheque, cash or debit). Please leave payments at the office in our secure drop box and include the bill stub. Payments may also be made at most financial institutions or visit your bank's branch for assistance. You have the option of signing up for one of two Pre-authorized Payment Plans.

You also have the option of receiving your tax bill electronically, if you would like it emailed to you please email generalmail@blandfordblenheim.ca.

Pre-Authorized Payment Plans for Property Taxes

The Township of Blandford-Blenheim offers two convenient Pre-Authorized Payment (PAP) Plans to help you manage your property tax payments, with no service fees.

4-Installment Plan

Your tax instalment amount is automatically withdrawn from your bank account on each scheduled due date.

10-Month Plan (January–October)

Payments are withdrawn on the 15th of each month from January through October.

-

January to July payments are based on an estimated amount.

-

In early July, you will receive a letter outlining the adjusted amounts for August, September, and October, based on your finalized tax bill.

-

The final three withdrawals reflect the actual balance owing.

Both plans help ensure your payments are made on time and eliminate the need to remember due dates.

Paying Online Through Your Bank

You can pay your property taxes through online or telephone banking with most financial institutions.

Add Blandford-Blenheim (TWP) Taxes as a payee, then enter your property roll number as your account number (remove all dashes and omit the last four zeros).

Please allow sufficient processing time to ensure payment is received by the due date.

If you require assistance, please contact the Township Office.

For full details about your property, use the MyProperty widget here

The Property Compliance Information Request Form allows property owners, purchasers, legal representatives, and related professionals to obtain official zoning, building, by-law, fire, drainage, or tax compliance information for a specific property within the Township. Each submission applies to one property only, and applicable fees (plus a 2% online customer service fee) are charged based on the type of information requested.